Depreciation formula example

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Diminishing balance or Written down value or Reducing balance Method.

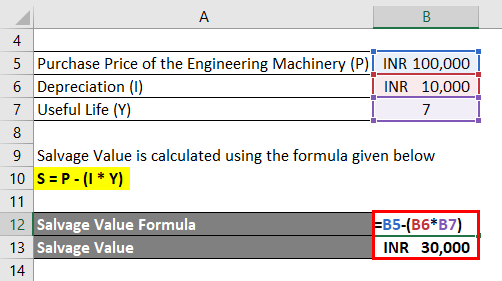

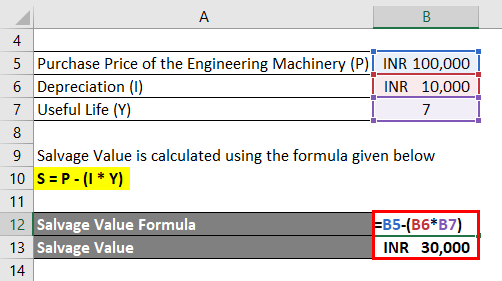

Salvage Value Formula Calculator Excel Template

Calculate the trucks depreciation for 2016 2017 and 2018.

. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. For example if a company purchased a piece of printing equipment for 100000 and the accumulated depreciation is 35000 then the net book value of the printing equipment is 65000. On 1 January 2016 XYZ Limited purchased a truck for 75000.

Calculating Depreciation Under Reducing Balance Method. Depreciation rate is the percentage decline in the assets value. For example if you buy a new oven this type of equipment naturally loses more value early in its life than it does later on.

If the asset is not losing value in a steady manner. Amortization and depreciation are two methods of calculating the value for business assets over time. This method is used by income tax authorities for granting depreciation allowance to assesses.

Inflation Formula Example 2. Interest the expenses to a business caused by interest rates such as loans provided by a bank or similar third-party. The calculation of depreciation under this method will be clear from the following example.

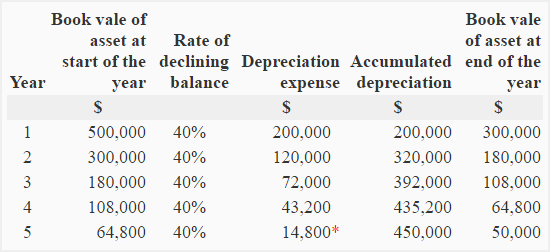

Depreciation is estimated at 20 per year on the book value. The straight-line depreciation formula is. Calculating Depreciation Using the 150 Percent Method.

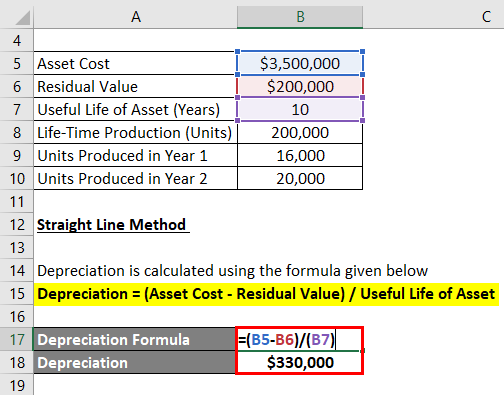

Formula for the Calculation of Depreciation Rate. A business will calculate these expense amounts in order to use them as a tax deduction and. Depreciation cost - salvage value years of useful life.

Let us take the example of Dylan who is an economist and wishes to compute the inflation rate in his state. He has created a CPI basket that includes food cloth fuel and education and has considered 2010 as the base year. Cost of asset.

Suppose the cost of asset is 1000 and rate of depreciation 10 pa. Below is a more in-depth definition of the key terms in Earnings Before Interest Taxes Depreciation and Amortization.

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

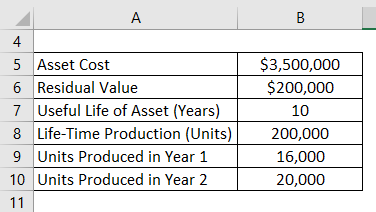

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Examples With Excel Template

How To Use The Excel Db Function Exceljet

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

How To Use The Excel Amorlinc Function Exceljet

Depreciation Calculation

Depreciation Of Fixed Assets Double Entry Bookkeeping

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management